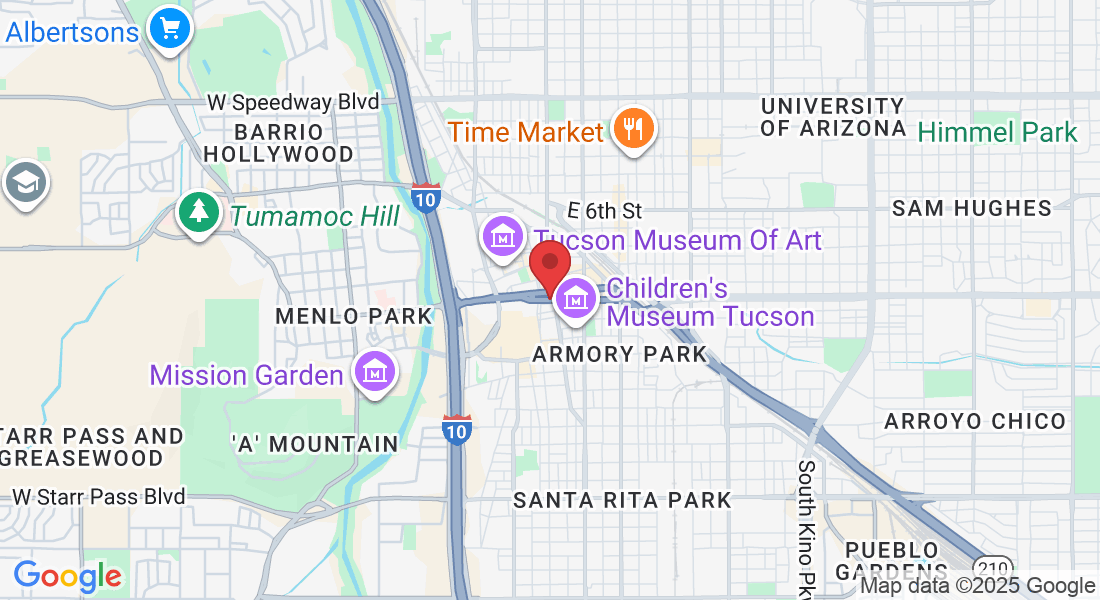

Real Estate Experts in

California, Arizona & the Coachella Valley

Full-service real estate and mortgage solutions for buyers, sellers, and investors — trusted across the Southwest with nationwide loan servicing.

"Let's Build Together" - David Armenta

DRE#02194781 #BR685383000 NMLS#2524421

Proudly Veteran-Owned. Locally Rooted. Nationally Connected.

Armenta Realty is a veteran-owned brokerage providing real estate and lending services across California, Arizona, and the greater Southwest region. Our mission is to help clients buy, sell, and invest with confidence — backed by certified market analysis, expert negotiation, and personalized mortgage guidance.

Complete Real Estate & Lending Solutions

Buying a Home

Whether you’re purchasing your first home or your next investment, our agents help you find the right property and secure financing that fits your needs — anywhere in California, Arizona, or nationwide.

Selling a Property

We use Certified Appraisals, Inspections, Market Analysis (CMA) reports, strategic marketing, and professional guidance to sell your home quickly and for top value.

Investing in Real Estate

From off-market opportunities to rental management and portfolio growth, our team helps investors across the Southwest.

Mortgage Loan Services

Through our nationwide loan servicing, we assist clients in financing, refinancing, and managing their properties.

Southwest Expertise with a Nationwide Reach

Headquartered in the Coachella Valley, Armenta Realty proudly serves clients across the Southwest — including Southern California and Arizona — with nationwide mortgage loan servicing for buyers and investors throughout the U.S.

Hear From Our Clients

Steven York

Our experience with this company has been outstanding. David Armenta has the ability to get things done through forward thinking and foresight. He has the unique ability to successfully choose prospective tenants that meets the client’s needs. his exceptional communication, skills and delivery of issues that needs to be completed are unremarkable. We are extremely happy with his performance. And would do it again I recommend his company to anyone.

Robert Orozco

David helped us both buy and sell a home. He is very professional and knowledgeable. We always felt that he had our best interests in mind. We never felt pressured to do anything we weren’t comfortable with. Would definitely use David for our future real estate needs.

Alexis Redondo

Best realtor I’ve ever met! Hands down! David not only sells homes for a job, but I feel he really invests himself into getting to know his clients and building a genuine relationship with them. He was so helpful with any questions we had. He made sure every aspect of the home buying process was easy to understand and that we were getting the best deal we can get. I highly recommend David for any one looking to purchase a home.

Ready to Move Forward?

Whether you’re buying, selling, or investing anywhere in the Southwest — or need nationwide mortgage servicing — Armenta Realty is here to guide you every step of the way.

"I am committed to giving my clients the attention they deserve. Getting to know my clients and their concerns is what I truly love doing."

- David Armenta

Ready to Finance Your Dream Home?

No hidden fees. Competitive Rates and Expert Support every step of the way.

Take the next step towards homeownership with our simple and fast loan approval process. Whether you’re a first-time buyer or looking to refinance, we offer personalized loan options to fit your budget and lifestyle.

Get Started Today - Sign Up Now for a Free Mortgage Consultation!

View Our Latest Articles

Example Blog Post

This is an example post to show the potential of a blog post. ...more

Mortgage and Financing

September 17, 2024•6 min read

Copyright © 2026. ORTIZ Real Estate Services, LLC. All rights reserved | Privacy Policy

Powered by Victory Metrics